Cold Storage Is HOT!

The need for cold storage is at record demand levels. According to MarketsandMarkets, the global cold chain market size is estimated to be valued at USD 233.8 billion in 2020 and projected to reach USD 340.3 billion by 2025, recording a CAGR of 7.8% Even before the pandemic, available cold storage capacity was difficult to find in most markets across the U.S. However, COVID-19 has had a major impact on cold storage demand, creating an even more acute cold storage supply issue. Many in the investor community are taking notice and multiple projects have been announced over the last several months. However, the escalating demand for cold chain infrastructure combined with multiple issues associated with both available and new cold storage supply present a complex set of factors in reaching market equilibrium.

Cold Storage Demand permalink

Before the pandemic, demographic and cultural changes in food preferences, as well as increasing e-commerce demands were already placing unprecedented demand on cold chain infrastructure. The pandemic then supercharged these trends and created new ones. As an example, according to The American Frozen Food Institute (AFFI) and FMI, frozen food sales gained 21% in 2020 versus 2019 This increase over an entire year is indicative of the staying power of the frozen food trend. According to recent IRI data, the demand for frozen foods suggests a strong start to 2021 as well: Frozen-food sales were up 19.4% in dollars in January year over year, compared with a growth of 11.4% for fresh perimeter foods. Examples of other factors contributing to the increasing consumer demand include:

- Consumers are demanding fresh food offers as well as fresh produce availability all twelve months of the year.

- Many consumers are tiring of cooking at home and the convenience of meal kits and frozen, convenient offerings is creating increased demand.

- Grocery e-commerce/BOPIS (Buy online, pick up in-store) is driving additional capacity requirements in downstream locations as grocery chains add distribution space to support this activity. Much of this space is located in urban areas because of the need to be closer to the customer.

- At the same time, frozen and refrigerated manufacturers/processors require additional capacity to fill the increased demand for their products. These upstream production requirements may supplant the on-site cold store storage and drive additional new requirements nearby.

- The general increase in population growth and the increasing amount of discretionary income consumers spend on fresh and organic foods has continued to drive demand, often outpacing supply added in the marketplace.

- Food shippers of all sizes are moving closer to market demand creating the need for more space in urban areas. This has created the need for new cold storage facilities with multiple rooms to support a host of shippers with similar temperature and distribution requirements.

While these and other factors demonstrate the strength of the underlying consumer demand, the conditions experienced during the pandemic have caused suppliers to develop responses such as increased safety stocks that place even further pressures on the cold storage demand. An illustration of the potential impact of these responses can be seen in how overall temperature-controlled inventories may be impacted. In general, many frozen food suppliers may hold approximately six to eight weeks of inventory. As a reaction to the increased consumer demand as well as to bolster safety stock in response to stockouts experienced at the onset of the pandemic, many food suppliers are seeking to build additional inventory. For perspective, an increase in inventory of one additional week increases the relative requirement of 12% to 17% for additional cold storage. These are new requirements over and above driven by the consumer demand factors outlined above. In some cases, the demand requirements have created a new need to move from a “just-in-time” to a “just-in-case” inventory strategy.

Cold Storage Supply permalink

As mentioned earlier, available cold storage capacity was in short supply even before the pandemic. Multiple factors contribute to this issue and include:

- Facility construction and equipment may cost twice as much (or even more) as a conventional warehouse. Add to this, the current environment of escalating construction costs with steel costs increasing by as much as 25%.

- Annual operating costs are significantly higher than dry storage due to the climate-controlled requirements.

- Operating requirements can be complex and may include compliance with FMSA or FDA regulations. Also, e-commerce requirements create fulfillment challenges of handling smaller orders with quick turns within a cold (refrigerated and frozen) operating environment.

- Long-term customer contracts are not generally the norm with customers seeking the flexibility to switch providers as the need arises.

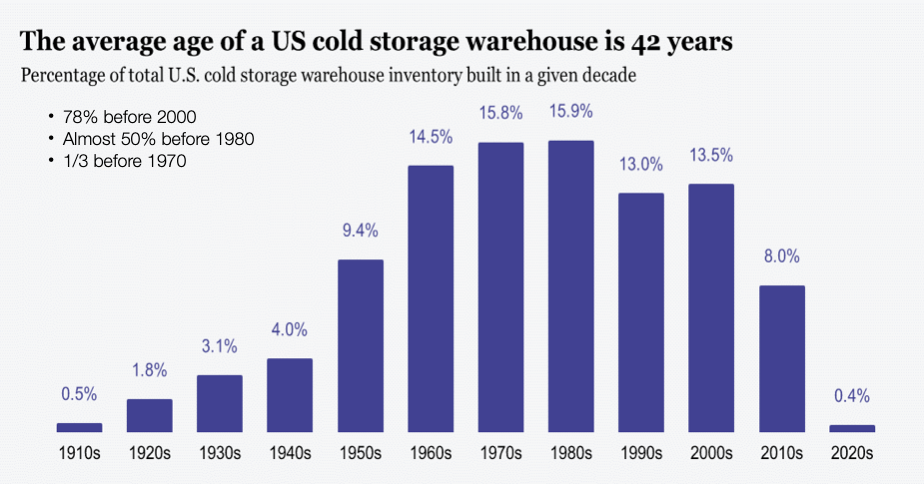

A further complication of the cold storage supply issue is the functional obsolescence associated with the current cold storage network. The flexibility of the cold storage network throughout the U.S. is limited due to functionality issues, such as ceiling heights, temperature capabilities, processing requirements, etc., caused by the obsolescence of older cold storage facilities in many markets. The graphic from Supply Chain Dive below illustrates the scale of this issue:

It is often more costly to retrofit an older facility than to build a new one. Replacement of refrigeration systems with newer more efficient ones, adding technology, improving overall energy efficiency, etc. generally exceeds the cost-benefit of the retrofit versus new construction.

Opportunities Have Generated Significant Activity permalink

As the cold storage demand versus supply imbalance has become more pronounced, the market is responding with significant activity ranging from acquisitions to new construction and a new strategy to fill the void.Examples of some of these trends include:

- Several facilities are being developed on spec which is rarely done for cold storage because of the high cost.

- Significant acquisition activity has occurred by Lineage and Americold (largest players) to create larger networks. The large providers are also building new facilities with very large capacities and automation.

- Other regional, smaller cold storage providers are also combining to create national networks of smaller providers. These providers can provide responsive services for small to mid-size shippers at competitive rates. These regional providers can also provide economies of scale due to the combination or merging of like types of products into larger shipments. As such, these smaller shippers can have a cost structure comparable to larger shippers.

- New investor groups with significant capital seeking to leverage opportunities with potentially higher returns than in the past have entered the market.

- Many foodservice providers, who experienced sharply lower demand because of the Covid impact on their customers, have responded by changing their strategies to accommodate a public refrigerated warehouse (PRW) model in some markets and have been able to add additional capacity to the market. This shift in an operating model has added much-needed revenue while keeping their workforce employed.

Conclusion permalink

The requirement for additional cold chain infrastructure is an intriguing development affecting both industry and consumers alike. The food we order as meal kits or online through the grocery store and the new demand for the center of the grocery store frozen foods has reverberating impacts throughout the cold chain. These issues are creating new opportunities for investors and other market participants but at the same time have significant risks.

Construction cost per square foot of cold storage, depending on the market, can be in the range of $200 and even and as high as $400+ per square foot. (These significantly higher costs have been noted in specific markets and sites.) In addition, the operational requirements for a cold storage facility are much different than many dry facilities and create much greater complexity.

Our work and recommendations for clients to proceed in the development of a facility are based on verified volumes from selected shippers. In other words, a $30 MM investment cannot be based on trends. Further, operating conditions, customer mix, and specific requirements must be gauged. Otherwise, the development of a facility-based even on well-established macro trends would be a risky proposition. It is essential that the proper levels of diligence, mostly driven by customer-centric market demand and operational requirements, be performed.